Contribution payable under the EPF MP Act 1952 or only the employees share depending on the employment strength of the establishment directly to the Universal Account Number of eligible employee maintained by the EPFO. Lifestyle Purchase of personal computer smartphone or tablet for self spouse or child and not for business use.

The Scheme stands commenced from 1 st October 2020 and shall remain open for registration of eligible.

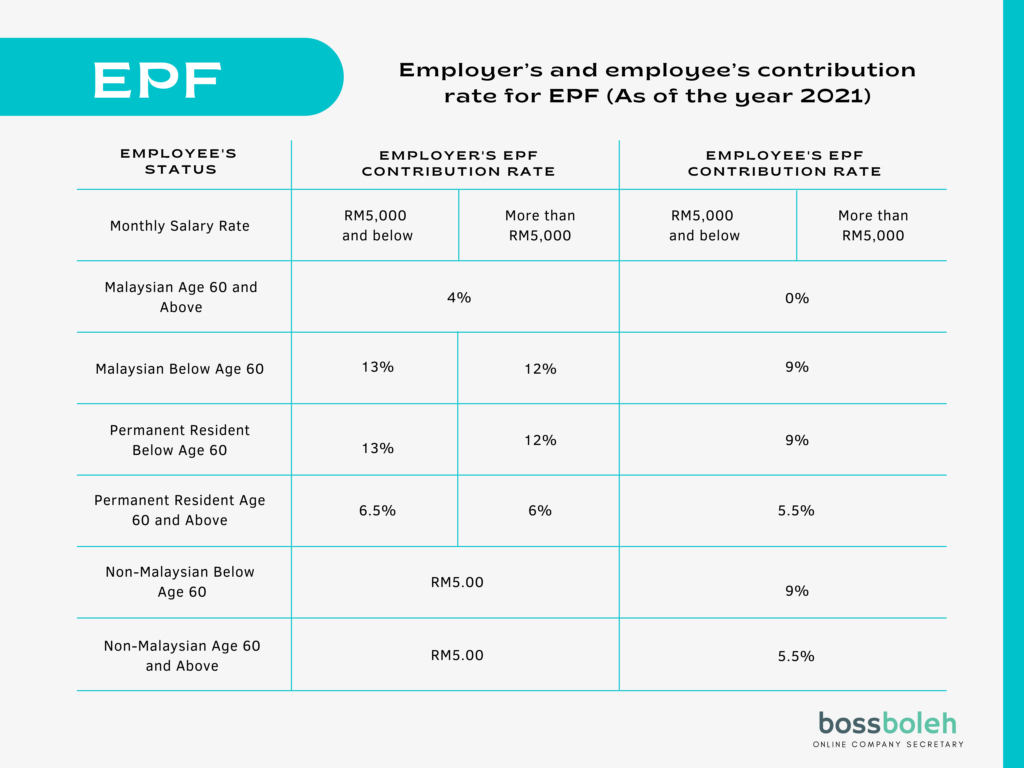

. Similar to EPF SOCSO contribution will be deducted from both employees and employers funds and will be paid every 15th of each month. There are a few channels SOCSO have disclosed on where employers may auto deduct from. The sums to be credited to the individual accounts of members 11 19.

In computing the amount of a contribution 8 14. Any extra contribution will go into EPF. This deduction is an addition to the deduction granted under item 10.

To check your PF balance online click on the For Employees button. EPF helps you achieve a better future by safeguarding your retirement savings and delivering excellent services. Imposition of surcharge on employers on failure to pay contributions on due date 10 17.

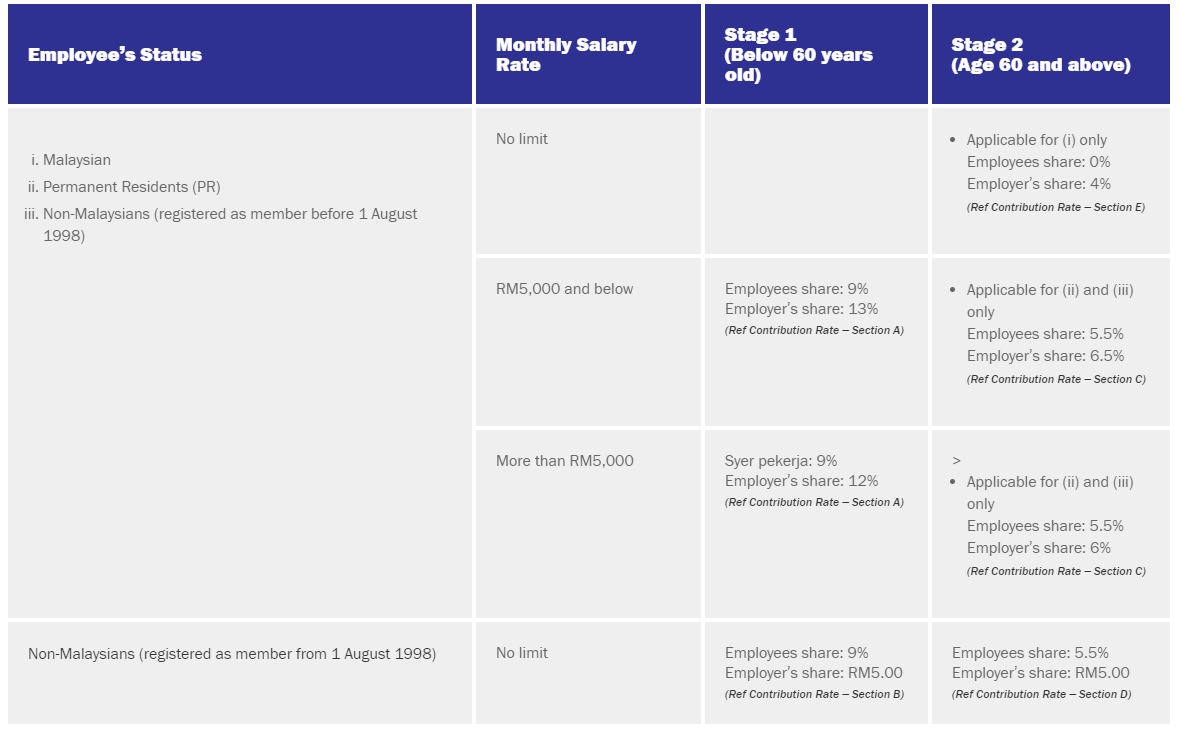

Payment of contributions due from employees 9 16. As for the amount that needs to be contributed this can be calculated based on the employees wages and the Third Schedule of the Act not by exact percentages unless monthly wages. For an employer to make the EPF online payment they must be registered under the PF Act.

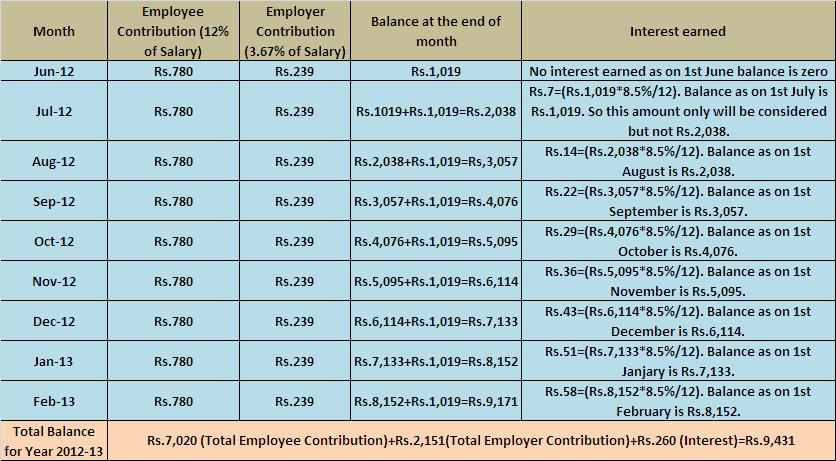

Employees who have claimed tax exemptions on EPF for Section 80C are not eligible for tax exemptions. Such interest is paid only on the operative PF accounts of employees who are yet to retire. When an employer fails to deposit the EPF contribution before its deadline then he is liable to pay an EPF interest of 12 pa.

In this guide we discuss how employers can make PF online payments. EPF Interest for Late Payment under Section 7Q. However members are entitled to receive a.

For every single day that there is a delay in EPF payment. Employer prohibited from reducing earnings of his. Check our guide to conduct PF balance check.

How to check EPF passbook. Purchase of breastfeeding equipment for own use for a child aged 2 years and. For EPFO portal balance check visit the EPF portal and click on Our Services on the dashboard.

Penal Damages for Late Payment under Section 14B. In case of non-restricted contribution PF will be on actual contribution ie 12 of 15500 1860 which is the Employee contribution. Employers contribution towards EPF Employees contribution Employers contribution towards EPS 550.

Interest on contributions 9 15. If the PF fund is transferred to NPS he she wont be liable to pay tax on withdrawal The liable tax depends on the employees salary in the withdrawal year. Also EPF withdrawals are liable to income tax if withdrawn before five years of service.

EPF subscribers need to log in to the official portal of the EPFO using their Universal Account Number UAN. Access to internet banking makes EPF contribution payments much easier now. Employer contribution will be split as.

Depay in EPF contribution by the employer incurs penal. It should also be noted that the share contributed towards Employees Pension Scheme does not accrue interest. Employees contribution towards EPF 12 of 15000 1800.

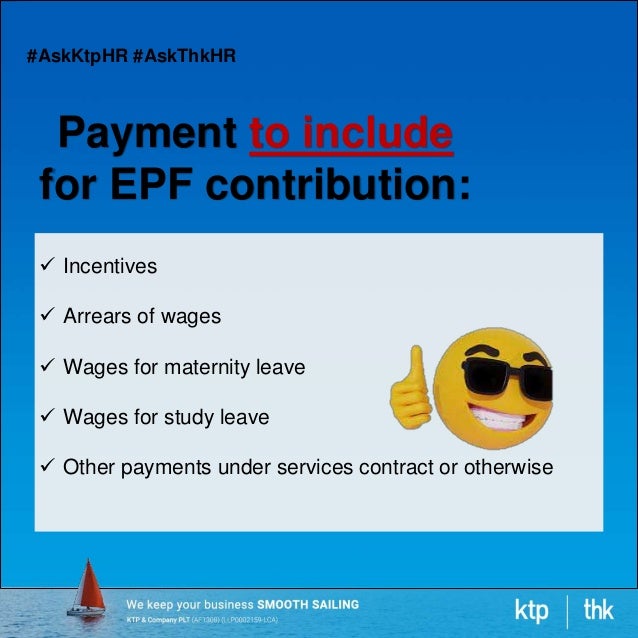

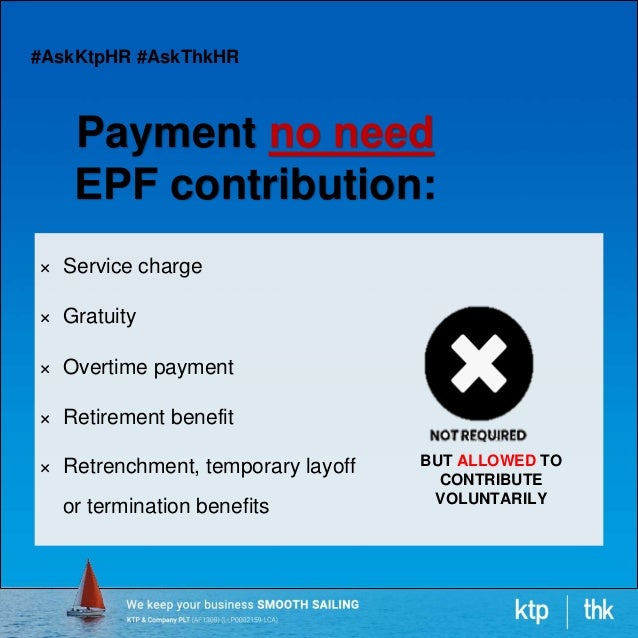

A late payment interest rate of 6 per year is imposed for each day such contribution is not paid on time. Payments that are liable for EPF contributions According to Section 431 of the EPF Act 1991 every employee and every employer must make monthly contributions to the EPF. TDS Tax Deducted at Source is applicable on pre-mature EPF Employees Provident Fund withdrawals of Rs 50000 or more with effective from June 1st 2015.

But the interest thus accrued on such accounts is taxed as per an EPF employee member s tax slab. Subject to the provisions of section 52 every employee and every employer of a person who is an employee within the meaning of this Act shall be liable to pay monthly contributions on the amount of wages at the rate respectively set out in the Third Schedule. Recovery of contributions 10 18.

EPS contribution will be a maximum of 1250. Total EPF contribution every month 1800. Log in with your.

Visit the EPFO official website httpsunifiedportal-empepfindiagovinepfo. You are actually allowed to withdraw legally only if it has been more than two months that you are out of work. Payment of monthly bill for internet subscription Under own name 2500 Restricted 11.

Employer contribution will be split as. They should pay tax on employees contribution employers contribution and.

Employees Provident Fund Or Epf Rules For Employer

Epf Interest Rate 2021 22 How To Calculate Interest On Epf

Contribution On Epf Socso Eis In Malaysia As An Employer Bossboleh Com

Employer Obligated To Pay Damages For Delay In Payment Of Epf Contribution Sc

Epf Contribution Rate Table Urijahct

Do You Need To Make Epf Payments For Bonuses And Cash Allowances In Malaysia Althr Blog

Employee Provident Fund Epf Changed Rules From 1st Sept 2014

How Epf Employees Provident Fund Interest Is Calculated

Epf Member Passbook For Tax Calculation Passbook Flow Chart Hobbies To Try

Pf Relief May Be Taxing In The Long Term Mint

What Payments Are Subject To Epf Donovan Ho

Epf Contribution Reduced From 12 To 10 For Three Months

Faq On Epf Payment Subject To Epf Jul 21 2021 Johor Bahru Jb Malaysia Taman Molek Service Thk Management Advisory Sdn Bhd

Explained All About How Your Epf Contributions Above Rs 2 5 Lakh Would Be Taxed